Want to claim a packers and movers bill? We provide **100% original and GST-approved movers and packers bill for claim** at affordable rates with a 100% Money-Back Guarantee.

Tread a 100% legal path to claim your Relocation Bill

Avail authentic and admissible packers and movers Bill with GST No.

Gets a hard copy of the packers and movers bill to claim reimbursement from your company

Choose an easy process to generate an original shifting receipt to save your time and energy

Table of Contents

Have you lost your relocation bill and are now struggling to get an allowance from your employer? If so, you don't need to fret. Dtc Express Packers & Movers is a renowned delhi based relocation company. We provide a 100% legal shifting or relocation bill for claim. So, as an experienced player in this field, we are in position to guide you in this situation. A correct guidance is imperative in such a situation. Without it, people often opt wrong ways to claim the allowance from their employer. Most often, presenting forged bills and lying through their teeth about its authenticity.

Employing this sort of way is not only pernicious to your credibility but it also can get you into trouble. Thus, it is advisable to tread a legal path to get your allowance. Go to a legally-registered company like Dtc Express Packers & Movers to get an authentic invoice. They will trump all your difficulties faced by you due to lack of packers and movers original GST bill. There are countless companies who claim to offer genuine packers and movers bill for claim. Conversely, very few of them deliver on their promise. So, to avoid being deceived by any fraudulent company, you can contact us to get a shifting receipt.

Claiming packers and movers bill is not rocket science, yet you require some tips to have in mind. Without knowledge of these tips, you might get a hard time to meet your goal of claiming packers and movers bill. To meet this goal with ease, you need to lay out a list of things to keep in mind. Well, we have got this burden off you shoulder by laying out such a list below.

1. Check the profile of the company thoroughly Yes, you have read it right. Before getting packers and movers Original GST Bill, you need to check legal status of the company. If the company is not legally registered or fraudulent, bill provided by them will not be admissible.

2. Verify the authencity of the Bill: - Once you get packers and movers Bill in your hands, verify its veracity before showing it to your employer. If it proved to be a fake packers and movers Bill, it might damaged your reputation and jeopardized your credebility.

3. Collect all the necessary documents: - Before providing allowance for your packers and movers Bill, employers ask to short all short of document. Thus, to claim your packers and movers shifting bill, collect all the necessary documents.

.webp)

GST (Goods and Services Tax) invoices can be tampered with or forged, making it challenging to discern whether they are authentic or not. In some instances, a trader might issue a GST invoice without a GSTIN (Goods and Services Tax Identification Number), which would be deemed fraudulent since the GSTIN is a prerequisite for any legitimate GST invoice.

There are several red flags that can help you identify a counterfeit GST invoice:

False GSTIN Usage: If a company that is not registered for GST creates a fictitious GSTIN on the invoice and imposes a GST, this is a clear sign of a fake invoice. The tax paid in this scenario would not be remitted to the government, as the GSTIN is not valid.

GSTIN Structure: Each taxpayer is given a unique 15-digit GSTIN, derived from their PAN (Permanent Account Number). Any deviation from this structure is a warning of a potential fake GSTIN. However, it's important to note that even if a GSTIN is correctly structured, it doesn't necessarily mean it is authentic or belongs to the company stated on the invoice.

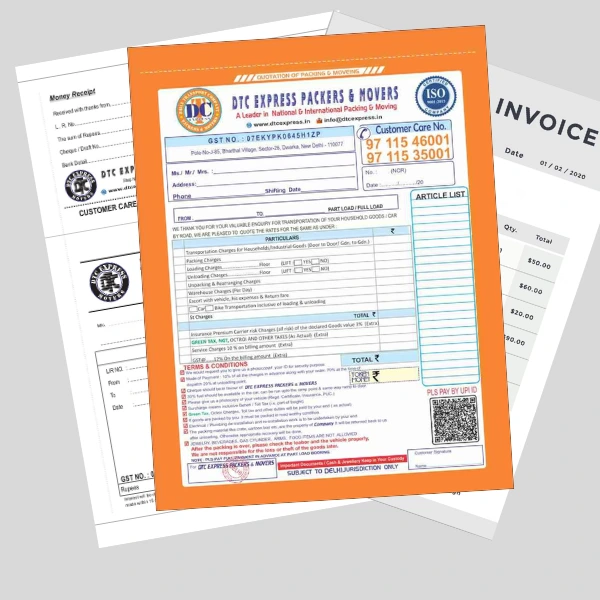

In order to claim your bill, certain documents are required, particularly when hiring packers and movers. The following documents need to be gathered:

Consignment Copy: This document is given to the consignee at the destination. It is duplicated four times: one copy is for the consignee, one for the consignor, one for the driver, and one for the office. It contains critical information such as the name, address, phone number, consignment number, terms and conditions, and item number. Sometimes referred to as 'Bulty', this is the primary document required for transportation.

Item List: This document is crucial when claiming your bill from your office as it determines the bill's value. It's not just important for insurance purposes but also helps you to inspect or tally the items when the packers and movers company unloads your belongings at the new location.

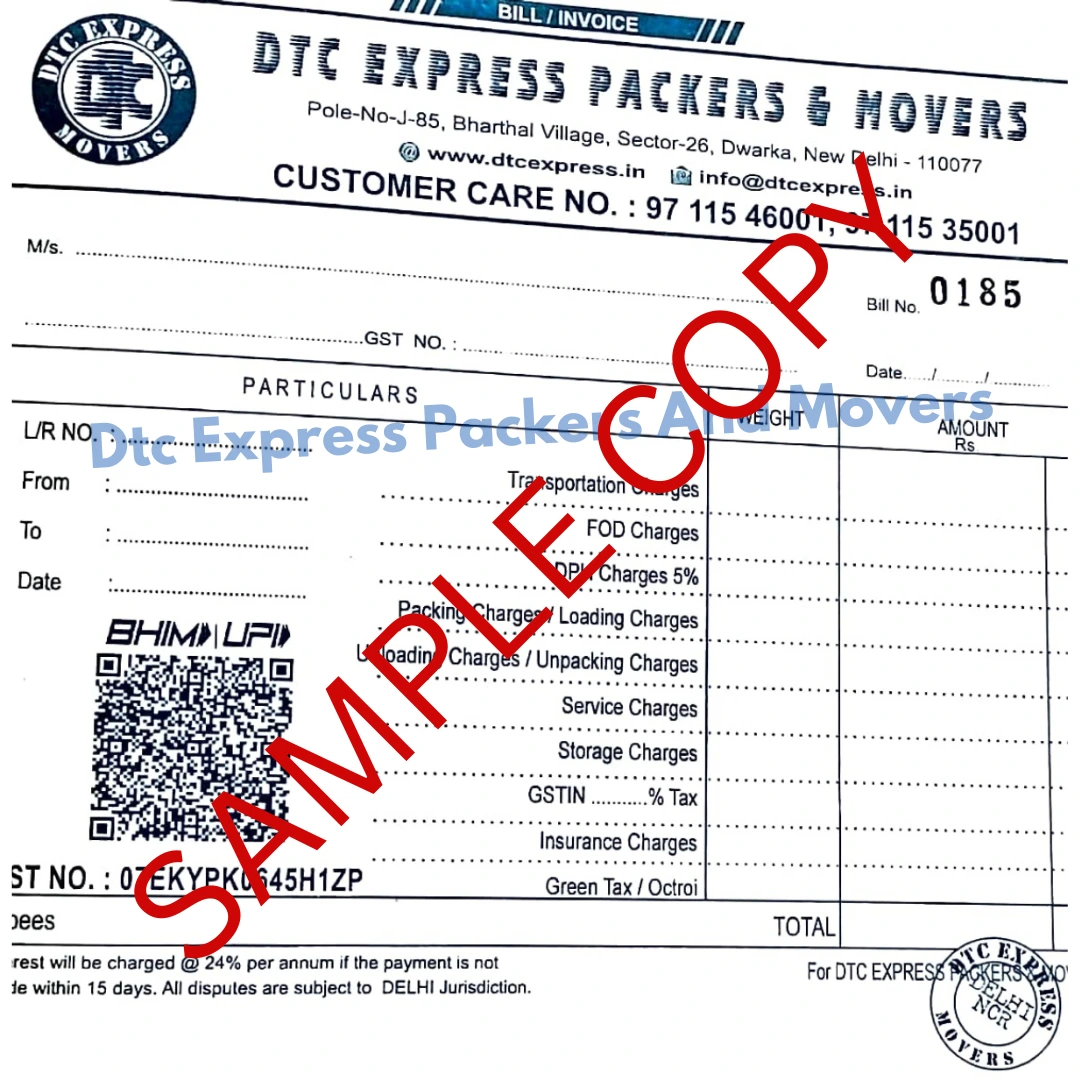

GST on the Bill Print: This is a paramount document when filing a claim. It separately lists elements like packing charges, transportation charges, loading and unloading fees, rearrangement costs, taxes, and insurance. It's vital to verify the GST number on this bill.

Receipt of Funds: You obtain this document when you make a payment in cash. It is then sent to the moving and packing company. This receipt serves as proof of your payment.

1. Quotation: This document is provided by a moving company in advance that you can get free of cost to get your shifting estimate.

2. Consignment or Bilty Copy: Bilty is the main document that contains unique docket no. with other important details like consignor and consignee name, address, contact number, vehicle number, and value of goods. This is called a bilty or consignment copy.

.webp)

.webp)

3. Item List: This is the list of all the household goods relocating from one location to another.

4. GST Bill Copy: The main and most important document you obtain from movers and packers is the authentic GST invoice.

.webp)

.webp)

5. Money Receipt: The cash receipt is proof of the amount you have paid the moving company for transporting your household goods.

If you have all these documents, then you can easily claim your shifting allowance by submitting them to your company employer.

When it comes to moving, the importance of the Packers and Movers GST invoice often goes unnoticed. To unlock the benefits of movers and packers GST billing, ensure you have the full set of documents - the GST invoice, payment receipt, and household items transport bill. But beware of counterfeits; always verify the originality of the transport bill.

To claim your dues, the Packers and Movers GST Bill Format is your lifeline. Here, you can dissect the precise charges for each service. Amidst the sea of packers and movers, authenticity prevails; watch for IBA-approved bill formats. A prime example is Dtc Express Packers & Movers, a torchbearer of transparency in their GST Bill Format.

.webp)

Unravel the mysteries, as some movers charge GST without a GST number or insight. With GST reform landing in India on July 1, 2017, the landscape shifted. We delve into how this affects both the packers and movers and the customers' wallets.

GST, the Goods and Services Tax, emerged on July 1, 2017, with its five-tier structure:

The Reverse Charge Mechanism takes center stage. The recipient pledges direct GST payment to the Indian government. If you're all about transport services, a flat 0% GST charge awaits, given you sport a GST number.

Picture this: disassembly, packaging, loading, transportation, unloading - a symphony of services. A mere transport journey dances at 5% GST. But when services don multiple hats, like packaging and labor, the curtains rise on 18% GST.

At 12%, we encounter the transportation solo. However, tossing in dismantling, packaging, or loading/unloading for house shifting ignites 18% GST across the stage.

A grand ensemble demands the 18% spotlight. From disassembly to insurance, the whole package graces the scene, pleasing both you and the Indian government.

The realm of luxury - gold, silver, and high-end couture - resides under the 28% banner. But for packers and movers, 28% is off-limits, enshrined in GST law.

IBA-approved entities, your guiding lights, ensure harmony with Indian government norms. Protection and insurance claims hold hands here.

This hybrid oasis, bundling labor, transport, and storage, bears an 18% tax burden. Mix and match services? Proportional calculation ensures fairness. A 5% voyage with personal packing shifts to 18% when the whole show dazzles with packaging, loading, unloading, and transportation.

Beware, for a 5% GST invoice betrays insurance claims. Opt for the cream of the crop - top-tier packers and movers - to savor a tranquil transition and beyond.

Dtc Express Packers and Movers is a trusted and leading packers and movers company in India. Our services are readily available to every resident all over the country. We value the fact that we also deal with people along with their belongings. Moreover, we understand that each of our customers has unique requirements when moving house and needs customised service.

Dtc Express Packers and Movers

G/F, Pole No-J-085, Near IICC Metro Station Sector-25, Dwarka, Delhi, 110077

Phone number: +91-9711546001

whatsapp No: +91-9711535001